Assessment Notices and Appeals

Understanding your Assessment Notice and Assessed Value

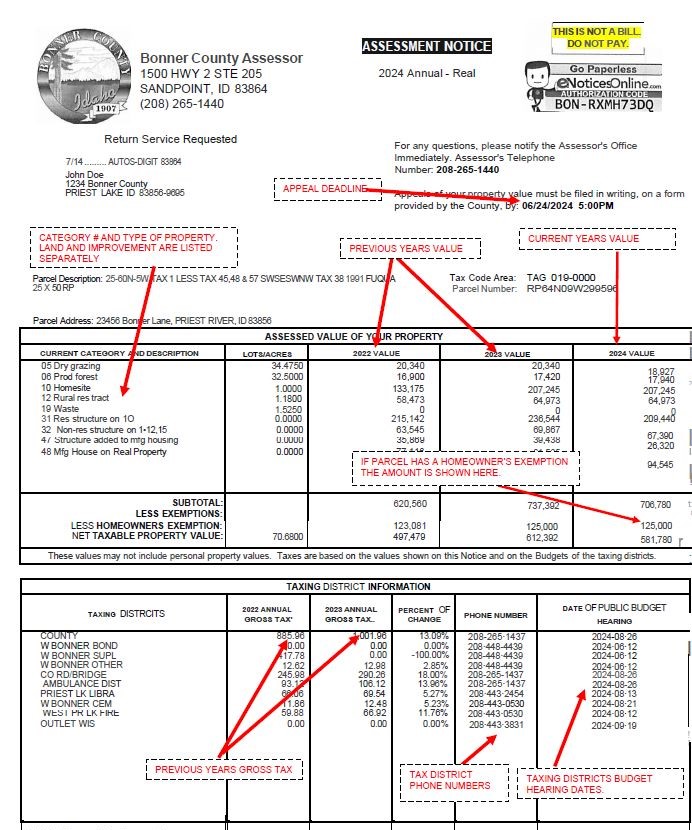

Notices for the Primary Assessment Roll are sent out no later than the first Monday of June each year. Assessments of property not on the Primary roll are sent out on the Subsequent Roll no later than the fourth Monday in November. Assessments not made on the Primary or Subsequent Rolls are sent out no later than the first Monday in January of the following year.

The Assessor is required by state law to place a current market value on all taxable property each year. This value is determined by an appraisal process, which includes analyzing construction costs, reviewing recent sales data, and may require a personal visit to the property. The sales information is gathered from the Multiple Listing Service, property owners, realtors, builders, developers, and independent appraisers. Please remember that your assessment notice is NOT a bill. Your property tax bill will be calculated after taxing districts set their budgets in the fall.

Click here to read the 2025 Assessment letter.

Assessment Notice Review Flowchart

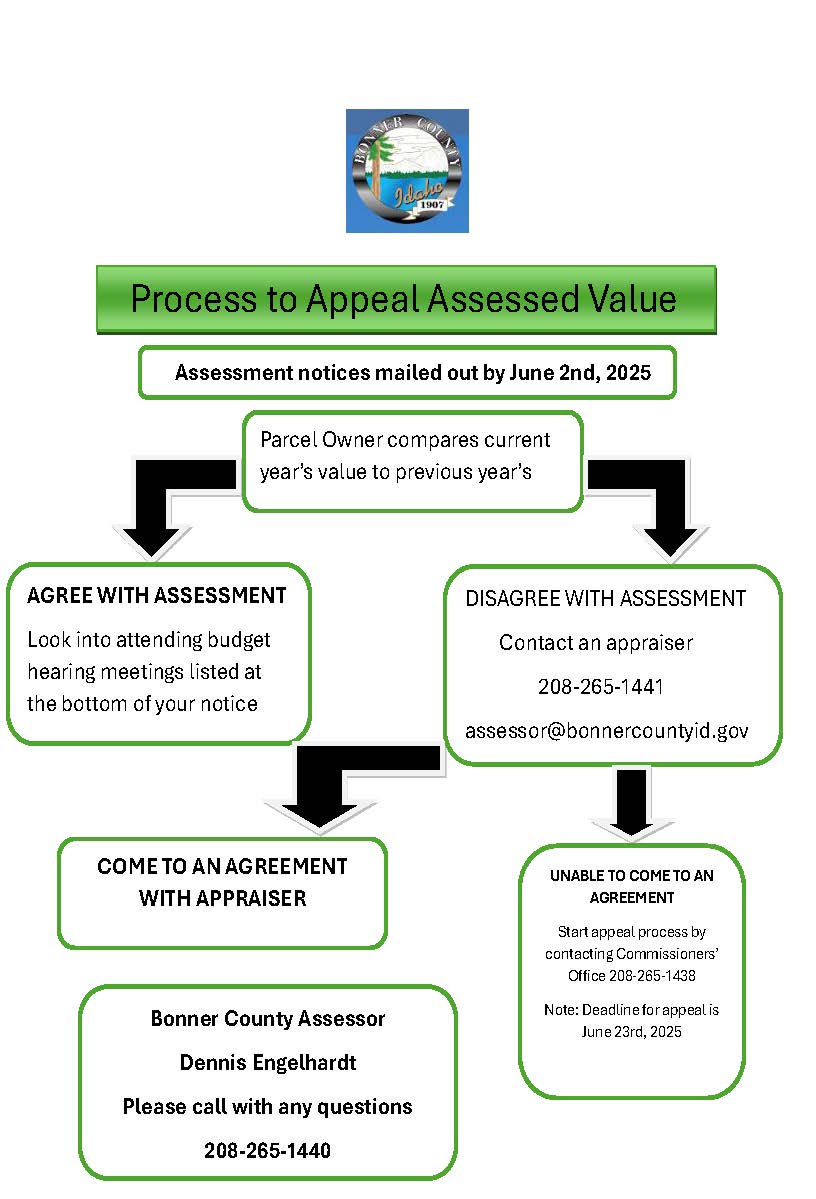

Discussing your Assessed Value with the Deputy Assessor (Appraiser)

If you feel that your assessed value is higher than what your property would probably sell for on the open market, then we encourage you to submit market information to support your position. The appraiser assigned to assess your property will consider any evidence you wish to submit. Typical market information comes in the form of a realtor’s comparative market analysis, copies of independent appraisals done for sales or refinance, repair estimates or any other pertinent data. Many property owners submit additional market information during the appeal process, and values may be adjusted to reflect the new evidence.

Board of Equalization (Filing the Appeal)

If you are not satisfied with the final assessment of value, it is your right as a property owner to file an appeal with the Bonner County Board Of Equalization. The appeal will only address the market value of your property. An appeal to the Board is not a forum to protest property taxes.

Appeal Forms

Appeal forms are available online from or the Bonner County Commissioner’s Office, 1500 HWY 2, Suite 308 Sandpoint Idaho 83864

Completed forms must be filed with the Bonner County Commissioner’s Office on or before the 4th Monday of June at 5:00 p.m. The Commissioner’s office will schedule a date and time for your hearing.

Contact Person

There is a place on the appeal form to list a contact person. It is very important that we know the correct name, address and phone number of the property owner or the property owner’s representative so that we may contact them, if necessary.

Presenting your Appeal To the Board of Equalization

“In a challenge to the assessor’s valuation of property, the value of the property for purposes of taxation as determined by the assessor is presumed to be correct; the burden of proof is upon the taxpayer to show by clear and convincing evidence that they are entitled to the relief claimed.”In short, you must prove that the assessed value is not market value through a factual or legal reason. In presenting your appeal, the best evidence is typically sales data from the marketplace, written analysis from a Realtor or other professional source. State your appeal objectively and factually. The Board of Equalization will give your case due consideration based on your evidence.

You can get your appeal form from the Commissioner's Office.

State Board of Tax appeal

If you want to appeal to the State Tax Appeal Board, you must first appeal to your local County Board of Equalization (BOE). The BOE appeal form must be filed by the 4th Monday of June . Please refer to Idaho Code 63-501A. A decision of the BOE is then further appealable to this Idaho Board of Tax Appeals or the District Court.

See Idaho Code 63-511.

Click here for more information and to visit the Idaho BTA website.